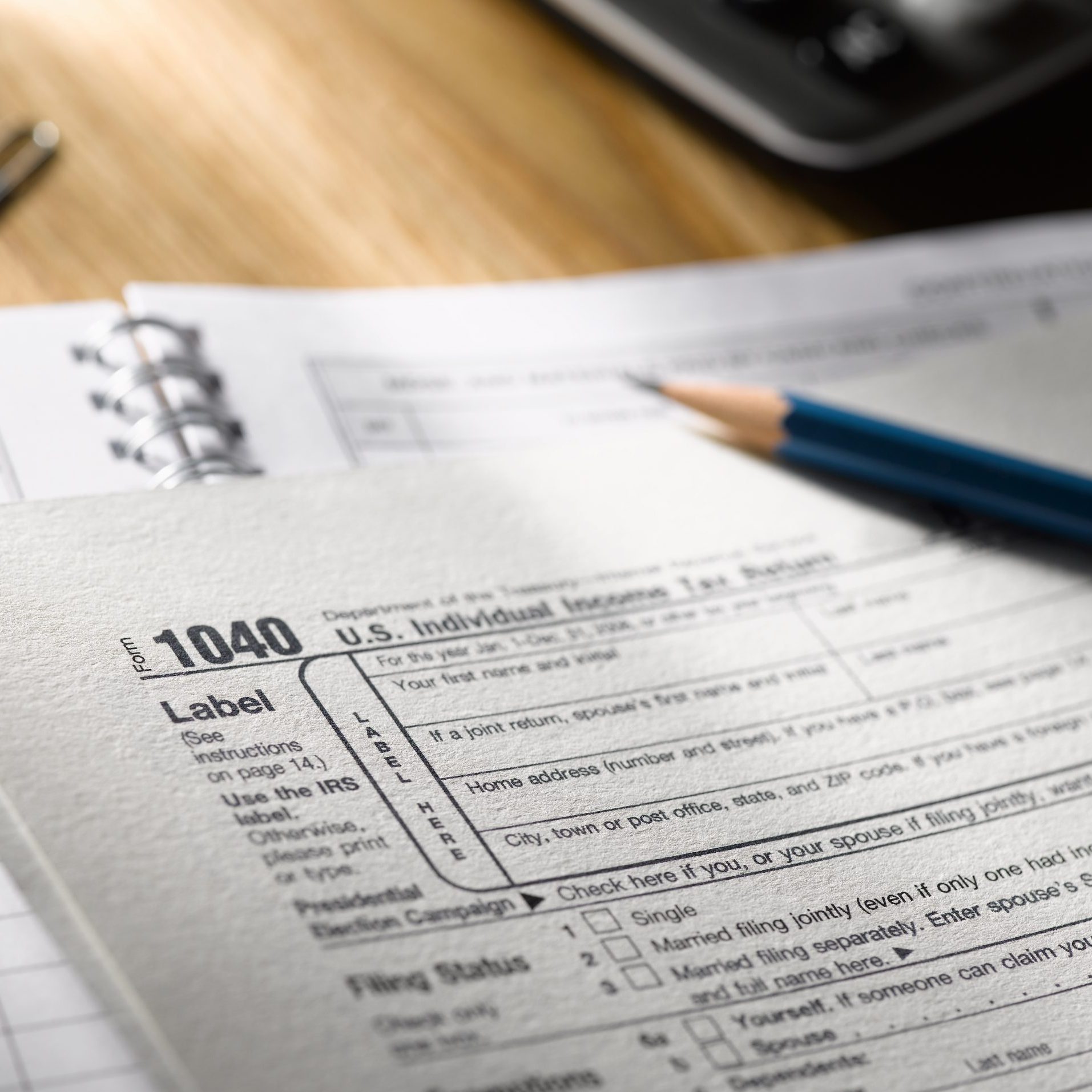

In many parts of the country, April marks a return to warm temperatures, landscapes marked by blooming foliage and perhaps even a colorful flower or two. April also signals tax season, a notion that may elicit different reactions than warmer weather and budding plants, particularly among those who do not anticipate receiving a tax refund.

According to the Internal Revenue Service, the deadline to file a 2023 tax return is Monday, April 15, 2024. Individuals who file more complicated returns or those who simply don’t have the time to file on their own typically look to tax preparation professionals to ensure their returns are filed correctly and on time. As the tax deadline draws closer, taxpayers who work with tax preparation professionals can make that partnership go more smoothly by ensuring they bring along these necessary documents and details to their appointments.

Social Security Numbers

Individuals who are filing as single or jointly with a spouse will need to list the Social Security numbers of each person on the return. Taxpayers with dependents will need to provide the full names and Social Security numbers of each dependent as well as their own Social Security numbers.

Identification

A copy of a form of identification, such as a driver’s license or passport, also must be included in a tax return. The identification confirms a person’s identity and the name on the ID provided must match the name associated with the Social Security number provided.

Income statements

Tax preparers need a copy of each taxpayer’s W-2 form, which employers must provide by the end of January. Taxpayers with more than one job must provide a W-2 from each employer. Additional income statements, such as forms indicating gambling winnings or retirement account distributions, also must be provided to the tax prep pro. Taxpayers who have such income should contact their tax preparation pro prior to their appointment to determine which additional income form they need to file.

Tax Deduction Documents

Tax deductions save taxpayers money, and taxpayers may be eligible for a range of deductions. For example, homeowners who finance their home purchases with mortgages will receive a 1098 form from their mortgage provider each January. That form is a mortgage interest statement that can help homeowners reduce their tax obligations. Donations, student loan interest payments and college tuition costs are some additional potential deductions. Charities, student loan servicing firms and colleges or universities should provide tax deduction documents by the end of January, and taxpayers can turn these forms over to their tax preparation professional so they earn all eligible deductions.

Receipts

Some expenses are eligible for tax deductions. Taxpayers can contact their tax preparation professional to determine if any medical bills, business expenses, charitable contributions, or additional expenses are deductible. Receipts may be required, and individuals are urged to hold on to any receipts they might be able to use to earn a tax deduction.

Tax season has arrived, and taxpayers are urged to provide all relevant documents to their tax preparers to ensure their returns are filed correctly and on time.